rhode island tax rates 2020

Essex Ct Pizza Restaurants. 2 Municipality had a revaluation or statistical update effective 123119.

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

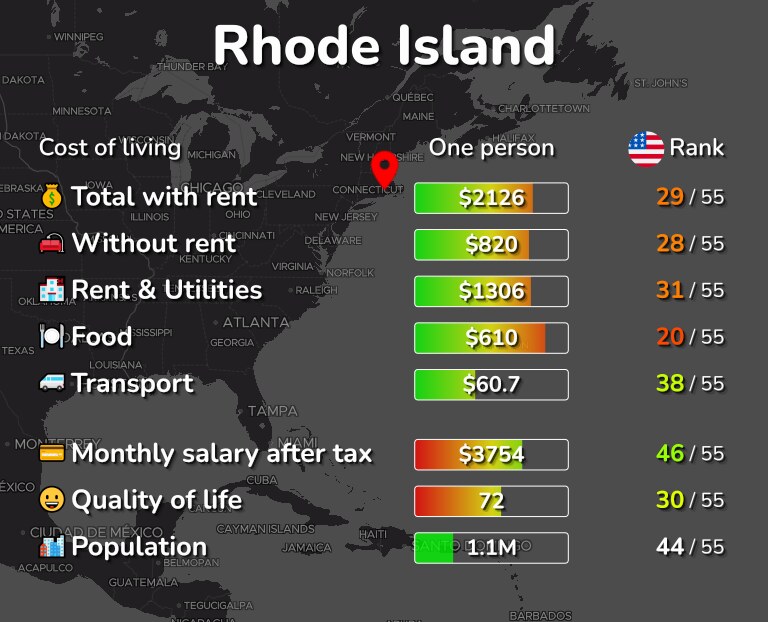

Across all states and the District of Columbia.

. Soldier For Life Fort Campbell. Rhode Islands tax system ranks 40th overall on our 2022 State Business Tax Climate. RI-1040 line 8 or Over But not over RI-1040NR line 8 0 66200.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. For East Providence the rates support fiscal year for 2020.

Assessment Division Resources. Some Rhode Island tax-related amounts for 2020 including income tax bracket thresholds and the standard deduction were released Nov. East Providence City Hall 145 Taunton Ave.

FY2022 Tax Rates for Warwick Rhode Island. Includes All Towns including Providence Warwick and Westerly. Find the Rhode Island tax forms below.

East Providence RI 02914 401 435-7500. Read the Rhode Island income tax tables for Single filers published inside the Form 1040 Instructions booklet for. Income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1.

The rates range from 375 to 599. 3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value. Rhode Island Cigarette Tax Rhode Islands tax on cigarettes is the fourth-highest in the US.

Warwick City Hall 3275 Post Road Warwick RI. Delivery Spanish Fork Restaurants. The tax breakdown can be found on the Rhode Island Department of Revenue website.

This page has the latest Rhode. 1 Rates support fiscal year 2020 for East Providence. Restaurants In Matthews Nc That Deliver.

Besides the state income tax The Ocean State has three additional state payroll taxes administered by the Division of Taxation. 375 of Income. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax.

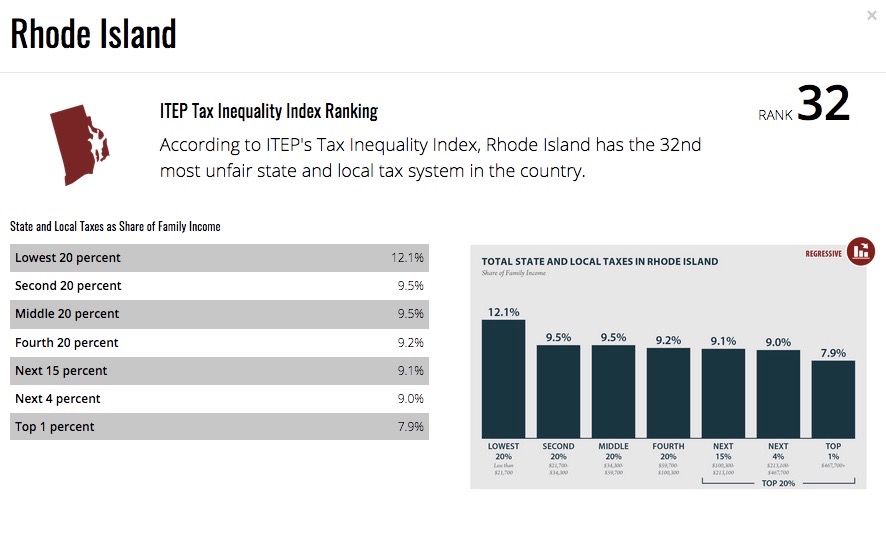

3 rows Rhode Islands 2022 income tax ranges from 375 to 599. Find your income exemptions. With tax rates ranging from 12 percent to 98 percent.

Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily. That sum 122344 multiplied by the marginal rate of 72 is 8809. Google names Warwick as Rhode Islands eCity.

Exact tax amount may vary for different items. Charlestown Coventry Cumberland Glocester Hopkinton North Providence Portsmouth Richmond and West Greenwich had a. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax.

The rate for new employers will be 116 percent including the 021 percent Job Development Assessment. 3 rows 2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and. FY2022 starts July 1 2021 and ends June 30 2022 Residential Real Estate - 1873 Commercial Industrial Real Estate.

The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. Sarah Frew City Assessor. 1 Unemployment Insurance 2 Job Development Fund and 3 Temporary Disability Tax.

M-F 8AM - 4PM Calendar. Of the on amount Over But Not Over Pay Excess over 0 66200 375 0 Use for all filing status types TAX If Taxable Income- Subtract d from c RI-1040 line 7 or Enter here and on RI-1040NR line 7 is. Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022.

The bottom of the threshold is 154 million so we subtract that from 1662344 million and get 122344. Rhode Island also has a 700 percent corporate income tax rate. Find your gross income.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Rhode Island Tax Rates 2020.

The thresholds separating Rhode Islands three income tax brackets are to increase to 65250 and 148350 up from 64050 and 145600 the division said in a notice. 2020 Tax Rates. Rhode Island Tax Brackets for Tax Year 2020.

Income Tax Rate Indonesia. Find your pretax deductions including 401K flexible account contributions. 2020 Rhode Island Tax Deduction Amounts.

A list of Income Tax Brackets and Rates By Which You Income is Calculated. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009. 13 by the state taxation division.

3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income. 2022 Rhode Island state sales tax. Opry Mills Breakfast Restaurants.

Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. 7 Rates rounded to two decimals 8 Denotes homestead exemption available 6 Motor vehicles in Portsmouth Richmond Scituate are assessed at. The Official Web Site of the State of Rhode Island.

The tax is 425 per pack of 20 which is 2125 cents per cigarette. Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. Finally we add 8809 to the base taxes 70800 to get a total Rhode Island estate tax burden of 79609 on a 32 million estate.

Thu 06102021 - 139pm.

Where S My Rhode Island State Tax Refund Taxact Blog

Opinion Dibiase Hiking Personal Income Taxes In Ri Will Hurt Economy

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Rhode Island Income Tax Brackets 2020

Rhode Island Estate Tax Everything You Need To Know Smartasset

Climate Change In Rhode Island Wikipedia

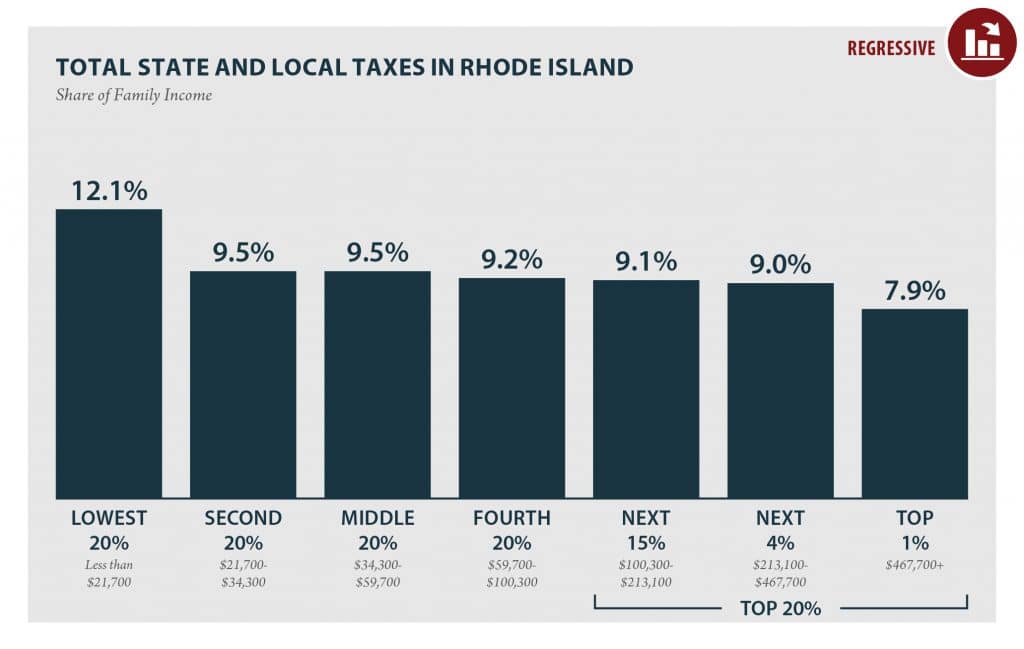

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Income Tax Calculator Smartasset

Rhode Island Landlord Tenant Laws Updated 2020 Payrent

Rhode Island Income Tax Calculator Smartasset

A Breakdown Of Washington County Rhode Island S Property Taxes For 2019 2020 Randall Realtors

Discover 20 Of The Most Interesting Facts Of Rhode Island Economic Ones Too