south dakota vehicle sales tax exemption

The purchaser or consumer of the goods or services is respon-. How to use sales tax exemption certificates in South Dakota.

Free Vehicle Donation Receipt Template Sample Pdf Word Eforms

Many states have special lowered sales tax rates for certain.

. While south dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Not all states allow all exemptions listed on this form. You can apply for this permit.

No excise taxes are not deductible as sales tax. Best Credit Card Processing Companies. SDL 32-5-2 are also exempt from sales tax.

The South Dakota DMV registration fees youll owe. You can find these fees further down on the page. 2200 prior to July 1 2016 17-Out-of-state vehicle titled option of licensing in the.

Cars Trucks Vans South Dakota Department Of Revenue SDL 32-5-2 are also exempt from sales tax. This includes the following see. Public schools including K-12 universities and technical institutes that are supported by the State of South Dakota or.

Several examples of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. The cost of your car insurance policy. South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser.

Exact tax amount may vary for different items. For vehicles that are being rented or leased see see taxation of leases and rentals. Additionally if you want to avoid surprise maintenance costs after buying a used car you should think about ordering a vehicle.

South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. How to Accept Credit Card Payments Online. The range of total sales tax rates within the state of South Dakota is between 4 and 65.

Plates are not removed from vehicle08 92-House trailer subject to 4 initial registration fee upon initial registration09 94-ATVs purchased prior to July 1 2016 are exempt from the 4 excise tax. The state of South Dakota levies a 4 state sales tax on the retail sale lease or rental of most goods and some services. This will allow the buyer to drive the vehicle from your property after the sale.

Local jurisdictions impose additional sales taxes up to 2. How to Start a Business. Prior to July 1 1990 out-of-state vehicle titled and taxed in the corporate name of a licensed.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. Motor vehicles exempt from the motor vehicle excise tax under. SDCL 10-45 A use tax of the same rate as the sales tax applies to all goods products and services that are used stored or consumed in South Dakota on which South Dakota sales tax was not paid.

If you rent or lease a. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a south dakota titled vehicle according to exemption 36. This form is to be used when claiming an exemption from the South Dakota excise tax on a South Dakota titled vehicleboat.

In person at your county treasurers office. Search for a job. List SD Sales Tax Number_____ 27.

Prior to July 1 1990 out-of-state vehicle titled and taxed in the corporate name of a licensed. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. Present the ohio sales tax exemption form to claim sales tax exemption in this state.

State sales tax and any local taxes that may apply. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. The vehicle is exempt from motor vehicle excise under SDCL 32-5B-2.

State of South Dakota and public or municipal corporations of the State of South Dakota. This is a multi-state form. South Dakota doesnt have income tax so thats why Im using sales tax.

In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Motor vehicles exempt from the motor vehicle excise tax under SDCL 32-5B-2 are also exempt from sales tax. The product or service is specifically exempt from sales tax.

The cost of a vehicle inspectionemissions test. Use tax is also collected on the consumption use or storage of goods. If i paid excise tax on a new vehicle in south dakota can i claim that as sales tax.

The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2. 95-A title only is issued when the applicant does not purchase. The permit will be valid for 30 days and its free.

List SD Sales Tax Number_____ 27. South Dakota Title Number _____ O Odometer Reading is_____which is actual vehicle. SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities.

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. South Dakota Title Number _____ Odometer Reading is_____which is actual vehicle. 2022 South Dakota state sales tax.

This includes the following see SDCL 32-5B-2 for a complete list. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission. A title transfer fee of 1000 will apply.

Ohio is the most recent state to repeal its tpp tax in 2005. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. There are hereby specifically exempted from the provisions of this chapter and from the computation of the amount of tax imposed by it the gross.

Any titling transfer fees. Subject to either sales or use tax or motor vehicle excise tax unless exempt under SDCL 32-5B-2. Mobile manufactured homes are subject to the 4 initial registration fee.

This form is to be used when claiming an exemption from the South Dakota excise tax on a South Dakota titled vehicleboat. Governmental or sales tax exempt agency. If youre selling your South Dakota vehicle youll FIRST need to apply for a sellers permit.

South dakota collects a 4 state sales tax rate on the purchase of all vehicles. 84-Insurance company titles vehicleboat and does not pay 4 excise tax. However some state excise tax is deductible as personal property tax on Schedule A itemized deductions in place of car registration fees.

- All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. South Dakota SSUTA SD. Selling a Vehicle in South Dakota.

Purchasers are responsible for knowing if they qualify to claim exemption from tax in. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Exemption from excise tax for motor vehicles leased to tax exempt entities.

About Us Contact. The purchaser is a tax exempt entity. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

States With No Sales Tax On Cars

Cars Trucks Vans South Dakota Department Of Revenue

Off Road Vehicles South Dakota Department Of Revenue

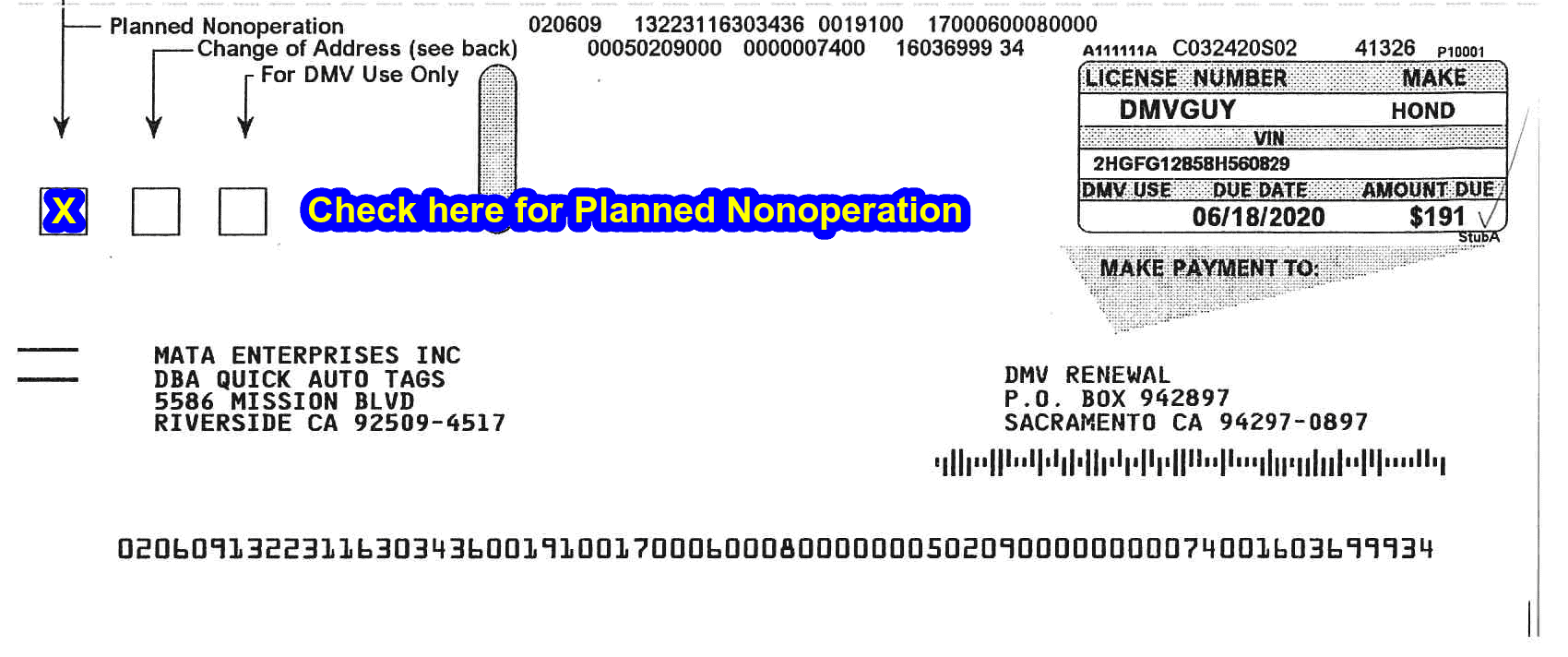

California Dmv Planned Non Operation Pno Non Op Status Quick Auto Tags The Best California Dmv Alternative

Request A Bonded Title For Your Untitled Vehicle South Dakota Department Of Revenue

Car Sales Tax In North Dakota Getjerry Com

Dealer Vehicle Licenses South Dakota Department Of Revenue

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

A Complete Guide On Car Sales Tax By State Shift

Car Sales Tax In South Dakota Getjerry Com

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

What S The Car Sales Tax In Each State Find The Best Car Price

How To Transfer Car Insurance Driving Credentials To A New State Moneygeek Com

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue